(1).jpg)

The number of deals that take place around the world every year is growing rapidly. At the same time, they are becoming significantly more complex, involving multiple markets and industries. However, studies show that 80% of mergers and acquisitions globally fail to create value. In more than 30% of these, cultural misalignment is one of the key reasons cited for failure.

Data-based culture due diligence: a new practice

Cultural incompatibility is the single greatest reason that deals fail to create value.

However, the due diligence phase of M&A transactions still focuses primarily on financial and legal aspects of the deal and excludes an examination of culture and potential cultural misalignments that could undermine the vision and financial objectives of the dealmakers. Too often, culture is treated simply as a buzzword and remains unaddressed until after a deal is closed.

The difference between a successful merger and acquisition (M&A) deal and a troubled one often hinges on whether culture is assessed in the due diligence phase of a transaction. Successful transactions require a holistic view of culture at an early stage, and a strong focus on people-related issues.

Yet ‘cultural due diligence’ is virtually unknown because investors lack a clear way to measure culture.

Data-driven culture intelligence to sharpen merger & acquisition strategies

To address this need, Culturelytics has created the world’s first AI-driven analytics platform designed to help acquirers conduct data-based culture due diligence.

.jpg)

Equipped with this data-driven culture intelligence, buyers can sharpen their deal strategies by adjusting valuation to account for cultural issues or planning effective interventions to improve cultural alignment.

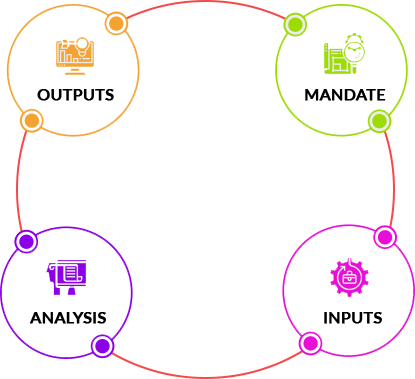

We use a four-step process to provide our clients with smarter, clearer, more relevant data on culture than has previously been possible.

We measure what matters, based an in-depth understanding of your business mandate.

Informed by the latest behavioural science, we collect smarter data.

We use the power of AI to analyse the data, turning the complexity of culture into clear insights.

You get data-driven culture insights that are clear, detailed and actionable.

Data-driven culture insights. Smart interface for leaders.

Culturelytics founder, Yeshasvini Ramaswamy, played an active role in the Apex’19 Summit & Awards. The annual event is attended by the leaders of India’s premiere private equity and venture capital firms.

Ms. Ramaswamy took part in the kick-off event, at which a senior panel discussed a range of topics, including emerging trends in venture capital investments and exits, the sectors investors are currently looking to back, key legal and regulatory pitfalls, and more.